LED screens are primarily manufactured in China, South Korea, Japan, and Taiwan. China leads with over 70% of global production, focusing on large-scale displays. South Korea specializes in high-end screens, while Japan and Taiwan supply precision and specialized components for consumer electronics and automotive displays.

China

In 2023, more than 70% of the world’s LED displays were produced by China, making it top of the LED screen manufacturing ladder. They range from electronic household items to huge outdoor installations. Shenzhen, then, is the centerpiece of that success and is colloquially known as the “Silicon Valley of Hardware.” The city hosts thousands of LED screen factories, manufacturing anything from 5-inch smartphone screens up to massive 100-foot outdoor advertising displays. Based on industry reports, this could be due in part to the fact that Shenzhen-based factories have a highly integrated supply chain, which reduces production time in places other than Shenzhen by up to 30%. This efficiency enables the Chinese manufacturers to supply their screens all over the world at very competitive prices, sometimes 20% cheaper compared to similar ones made either in Japan or South Korea.

For household applications, the Chinese-made LED screens dominated the world market for both TVs and monitors, accounting for approximately 85% of the LED TVs sold alone in the United States. More recently, however, Chinese companies such as TCL and Hisense have grown rapidly. The revenue of TCL in the North American market increased by 25% from 2022 to 2023. Hisense, for its part, whose affordable high-resolution displays have almost captured 12% of the North American market share, offers 4K and 8K quality screens for about 30% cheaper than their Japanese and South Korean counterparts. For instance, Hisense’s 55-inch 4K LED TVs, retailing for close to $400 in the US, are considered a competitive price that has made HD screens more affordable for the masses around the world.

China is also a power in the outdoor LED display market for very large displays used in advertising and sports stadiums. Unilumin, one of China’s largest LED outdoor screen manufacturers, provides large event and high-traffic area screens. In 2023, sales of outdoor LED displays at Unilumin rose 18%, buoyed by orders from major cities looking for screens that will save energy and can be seen very well. Those kinds of screens are usually more than 5000 nits in brightness to allow for visibility under direct sunlight, with a lifespan of approximately 100000 hours. The above-mentioned longevity is very good value for money to the businesses, as they reduce maintenance and replacement costs up to 25% over a ten-year period, compared to similar products from European manufacturers.

South Korea

The manufacturing of LED screens is world-class in South Korea, especially for high-end applications such as high-resolution TVs, smartphones, and sophisticated displays. Speaking of core developers, companies like Samsung and LG from South Korea have pioneered the technology behind LED, OLED, and QLED, which all culminate into some of the brightest, most contrasting, and color-accurate displays available on the market today. In 2023, the South Korean share may reach as high as 15% in value terms of the global LED screen market, which would be quite significant given the target for high-end and high-performance displays. Samsung alone generated about $28 billion from its display division in 2022, up 12% from the previous year, largely due to demand for high-resolution screens in consumer electronics and business settings.

Of the premium television market, South Korean brands are particularly mighty, with Samsung and LG holding more than 30% of the global market for 4K and 8K TVs combined. It is partly because Samsung’s QLED technology offers higher color accuracy and brightness, making it a favorite in North American and European markets. By 2023, Samsung QLED and Neo QLED TVs are taking up 21%, while LG OLED TVs hold about 18% market share, securing their position as leaders in high-end display technologies. Neo QLED models from Samsung boast an average brightness of up to 2000 nits to ensure perfect viewing in very bright environments—something rather serious for those buyers ready to pay for quality.

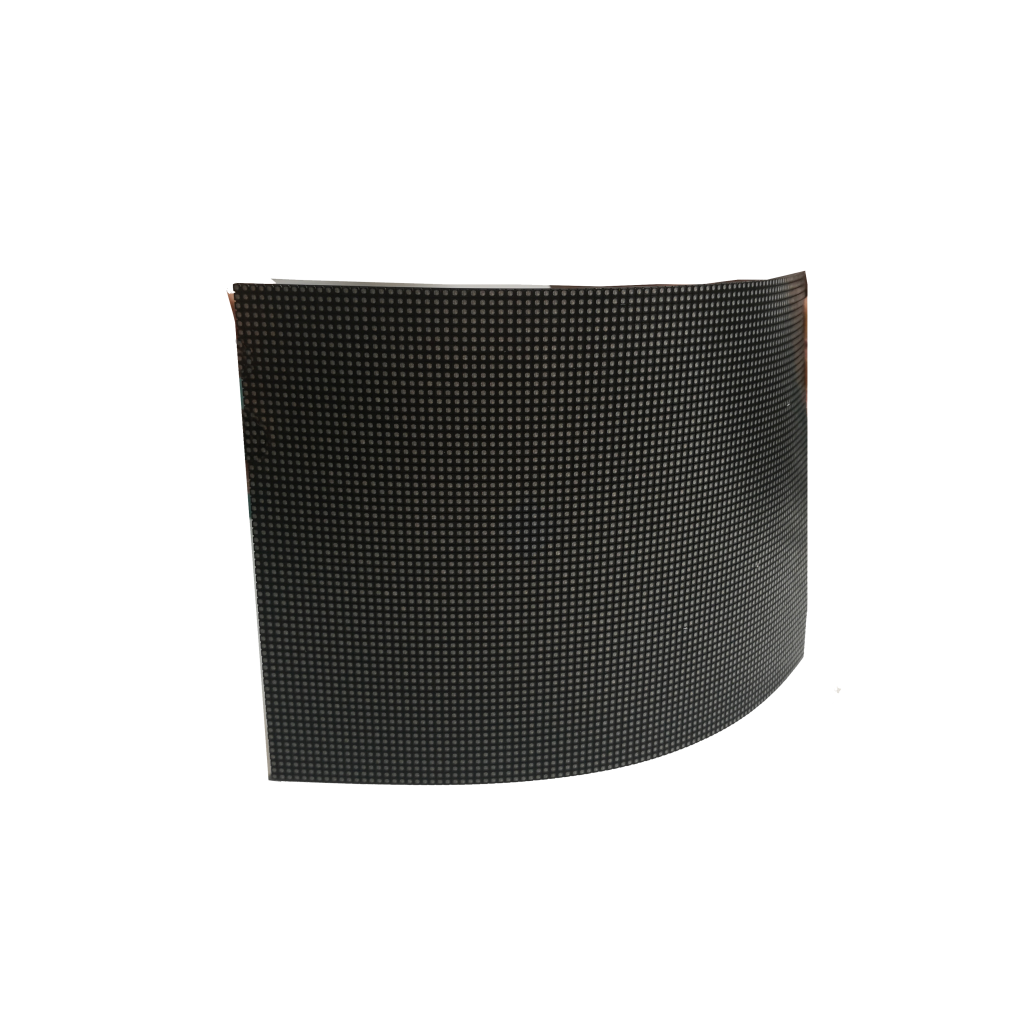

South Korea is also a significant player in providing displays for smartphones and mobile devices, where both Samsung Display and LG Display provide screens for leading brands worldwide, including Apple. At the end of 2023, it was estimated that around 70% of all OLED smartphone screens were on the supply end from South Korean firms, amounting to approximately $15 billion in sales. In particular, flexible OLED screens powering foldable items such as the Galaxy Z Fold and Flip saw 40% year-over-year demand, indicating increasing consumer interest in new form factors. On that note, Samsung Display strengthens South Korea’s position in the new generation of mobile displays, especially in segments where screen clarity, responsiveness, and longevity are critical.

Japan

Japan has long played a significant role in the market for LED screens and, in the general sense, display technology, especially in high-precision applications that have quality and innovation as their priorities. Firms like Sony, Sharp, and Panasonic have traditionally led the way in Japan in LED and OLED technology for specialized applications, especially in professional fields such as broadcasting, healthcare, and high-value commercial installations. The Japanese contribution in the global LED and display market, in terms of value, was approximately at 8% in the year 2023. More about the value of high margin products other than mass-market displays, Sony booked more than $9 billion in revenue for its professional and consumer display-related product offerings—a testament to the ongoing focus of Japan on quality and specialty use-cases.

These high-resolution screens of Sony, used in products like the Crystal LED display series, are extremely popular among professionals. These screens are favored for their exceptional color accuracy, contrast, and low latency—critical features for applications in broadcast studios, control rooms, and corporate environments. Boasting uptimes of up to 100,000 hours and offering perfect or near-perfect color reproduction, Sony’s Crystal LED display systems can realize 1,000-nit brightness. All these make Sony Crystal LED displays ideal for heavy usages. Sony increased Crystal LED production by 20% in 2023 to keep up with strong demand for these displays within a growing market for specialized high-performance LED screens.

Sharp and Panasonic are targeting high-value, power-saving displays for both residential and commercial applications in consumer electronics. Sharp has developed screens with excellent energy efficiency and a high pixel density suitable for TVs and mobile devices using the pioneering technology of IGZO, or Indium Gallium Zinc Oxide. Sharp’s IGZO display accounted for 15% of the global market in 2023 for high-resolution, energy-efficient panels. Presently, these displays boast of up to 30% lower power consumption compared with traditional LED displays, and they thereby become attractive not only to consumers who are ecological in their orientation but also to companies wanting to cut down operating costs when put into commercial use.

Taiwan

The contribution of Taiwan cannot be underestimated in the global LED screen manufacturing ecosystem—it still remains the most important supplier of all sorts of LED components, modules, and small and medium-sized screens for consumer electronics, automotive displays, and industrial equipment. Companies such as AU Optronics—a subsidiary of BenQ Corp—and Innolux produce LED and LCD screens, serving as critical components to larger international brands. In 2023, Taiwan’s display industry generated roughly $7 billion in revenue, capturing about 6% of the global market by value. This output underlines the strategic position of Taiwan, given how it’s a supplier of high-quality display parts and not complete LED displays mass-manufactured by its peers in China and South Korea.

In consumer electronics, Taiwanese companies serve screens for laptops, tablets, and monitors to the likes of Acer, Asus, and Dell. Take AU Optronics, for example, which develops high-resolution displays for gaming laptops—a specific portion of the market that was able to achieve a 15% increase in global demand in the year 2023 because of the constantly growing gaming industry. These gaming panels boast refresh rates from as low as 120Hz to as high as 360Hz, aside from ultra-fast response times and as high as 600 nits of brightness. This performance has made AUO’s displays particularly popular among gaming brands, with AUO noting 20% growth in this segment last year. On its part, Innolux has specialized in making energy-efficient LED screens for laptops, offering screens with a maximum power consumption of 25% less compared to regular LED displays. That fits with the rising consumer demand for longer battery life.

The display industry of Taiwan also plays a leading role in the automotive field. About more than 30% of all car displays sold worldwide contain Taiwanese-made components, with Innolux and HannStar leading this field. In other words, the number of vehicle models that have integrated displays manufactured by Taiwanese companies is on the rise. The majority of displays are measured between 7 and 15 inches and set up for digital dash, infotainment systems, and navigation displays. With global automotive makers asking for displays that boast better brightness and reliability, revenues of Taiwanese firms increase by 18% on a year-over-year basis because of the sales of displays to automotive clients. Conforming to safety and quality standards, displays intended for cars go through extreme temperature changes so that they will be able to bear long-term duties in vehicles used the world over.